A CIO’S SECRET TO SAVVY OUTBOUND PAYMENT PROCESSING:

THE DISBURSEMENT HUB

Guest Blogger

for Prelude Software

Wayne Umland

CIO (retired)

Glatfelter Insurance

During my 43 years in the Insurance Industry, including my responsibilities as the CIO at Glatfelter Insurance, I’ve had the good fortune to work on many projects and workflows that have been integral to the success of the business. In doing so, like any good manager, I’ve always been stringent in my vetting process to separate the wheat from the chaff and make sure we always netted the best alternative to meet our business needs.

One example I’d like to share is a solution that became much more than originally we intended. Prelude’s PayPilot ® solution was first on our radar as way to improve our check writing capabilities. Our requirement was very simple; find a solution that would allow us to migrate from pre-printed check stock to blank check stock. During the initial discovery process, we quickly realized Prelude’s PayPilot was not an ordinary check writing solution. In fact, to call it a check writing or check printing solution is really selling it way short!

If I had one big recommendation for Prelude, it would be, not to be so humble. However, I know first-hand it is not in their nature to beat their chest and toot their own horn. The folks at Prelude are trustworthy and great to work with. They are honest and reliable, available any time and the kind of people you quickly consider a friend, partner and colleague more than a vendor.

Although PayPilot is incredibly robust in its check writing capabilities, I can tell you PayPilot offers far more. Prelude recognized that insurance carriers have many originating core systems capable of creating payment requests. Whether claim payments from the claim system, premium refunds from the Policy system or vendor payments from the AP/GL system, as just a few examples, they designed PayPilot to work with them all. Basically, PayPilot becomes an extension of the core systems to extend the payment processing capabilities of each.

-resized-600.jpg)

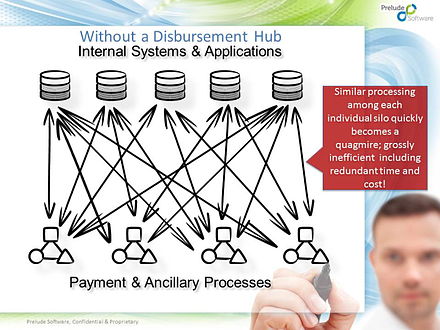

What PayPilot truly offers is a way to create and implement a scalable “disbursement hub” to make sure we are leveraging best practices for efficiencies across the enterprise. Let me give you an example. If we did not have a disbursement hub, but needed to add a capability, like scrubbing all outbound payments against Office of Foreign Assets Control (OFAC) list to be compliant with the U.S. Patriot Act, we would need to implement it to each core system separately meaning a significant amount of redundant time and cost - a waste of resources. With a disbursement hub, PayPilot, we can easily add the process this single hub and it’s done. We are able to implement changes and additions to our process faster and smarter.

The flexibility of PayPilot also offers ease to add new payment methods. Our goal to migrate off of paper checks to electronic payments was made easier because of PayPilot. Even the supporting stub information can be sent as a workable file to the payee eliminating the need to rekey data on their end. Of course, this is the low-hanging fruit that every carrier is after to reduce cost easily.

For Glatfelter, with Prelude able to integrate with almost any infrastructure, we didn’t have to replace anything to take advantage of PayPilot. Prelude took on the heavy lifting to interface with our core systems minimizing our internal implementation effort.

Prelude raised the bar for an outbound payment processing solution. Here are few key items your solution should include:

1. Be an enterprise-wide, disbursement hub

2. Interface with your core systems

3. Offer multiple payment methods;

a. Checks

i. Blank stock

ii. Pre-printed stock

iii. Partially pre-printed stock

b. ACH

i. Electronic payments

ii. Electronic remittance

i. Load-as-you go debit cards

i. No plastic - just the card number and exact dollar amount provided to payee

e. Payments via text or email address

i. PayPilot can act as the surrogate to digitally hand-hold the payee through the payment process

ii. Reduces the need for the carrier to collect and maintain bank account info

4. Offer ancillary processing

a. Positive Pay

b. Payee Positive Pay

c. Bank Reconciliation (cleared items from bank)

d. Interfaces with;

i. Escheat s/w

ii. 1099 s/w

iii. Document management s/w

iv. Business Intelligence (B.I.) s/w

v. Web Portal

vi. Client Dashboard

5. Enable field staff to issue payments

a. Remote / field payment capability

6. Keep a full audit trail of the entire life-cycle of each payment

7. Ability to limit the permissions and authority of each named user

8. Scale with your business needs (We started with check writing and grew our requirements and use of PayPilot over time.)

9. Enable flexibility, including as much self-service as possible

10. Be fairly priced

Hope this finds you well, is informative and helps with your objectives.

Kind regards,

Wayne Umland

CIO (retired)

Glatfelter Insurance