Read More

Prelude's Insights on Outbound Payments Blog

Tags: issue payments electronically, remittance data, integrity of payment data, provides transparency, self-service capabilities, bank agnostic, disbursement workflow, nimbleness straight through processing, cost savings, lifecycle of existing systems, add-on components, disbursement hub, Outbound Payment Processing, disbursements, make the process better, primary drivers, changes to process, regulation, security, competitive threat, flexibility, cost of issuing a paper check, improve process, paper, approvals, wet signatures, individual payments, vendors, bulking, single payment, remittance.electronic payments, issuing payments, electronic remittance, Positive Pay, Payee Positive Pay, reduce risk, Single Use Accounts, SUA, card payments, bank account information, recurring payees, issue payments to the one-off payees, payments via cell phone and email, bank account info, originating systems, methods of payment, ancillary processing, control, issuing outbound payments, reduce the costs of issuing payments, speed of the transaction, new payment methods, payments by cards, payments on location, disbursement processes, issue claim payments, issue payments, claim payments, checks, MICR checks, reconciliation, payee, transaction, claim settlements, enterprise-wide middleware, payment disbursement hub, insurance claims processing, claims processing improvement, increase customer satisfaction in insurance indust, lower cost of processing claims, reduce cost of processing claims, insurance industry trends, PayPilot, electronic payment, problems insurance industry faces, mobile insurance solutions, PointPay, insureds, Catastrophic Events, CATs, Funny Insurance Ad, Prelude's Payment Tips, Trends and Observations, same-day cash, iCareCard, re-issuance, reward, loaded, reloaded, Visa, discounts, payroll, commissions, dividends, refunds, interchange, fees, funds, safety, OFAC Compliance, US Patriot Act, fraud protection, fraud prevention, check fraud protection, check fraud, fraud, check fraud prevention, System Integration, 1099 Processing, virtual credit card payments, virtual credit and debit card payments, virtual card payments, how do virtual card payments work, in-n-out single use card, single use cards, single use card number, accept virtual credit card payments, virtual card payment implementation, virtual card payment, single use card numbers, credit card single use number, single use card, virtual card payment program, virtual card payment solutions, virtual card payments healthcare providers, receiving virtual card payments, virtual card for provider payments, multi-party ACH payment, eChecks, electronic checks, MasterCard Send, direct-to-debit payment, WEX, Deluxe, PartnerConnect, Partner, Partners, Guidewire, Accelerator, Accelerators, Zelle, Payee Payment Portal

Tags: issue payments electronically, remittance data, Outbound Payment Processing, disbursements, make the process better, flexibility, cost of issuing a paper check, single payment, reduce risk, SUA, card payments, control, issuing outbound payments, reduce the costs of issuing payments, speed of the transaction, disbursement processes, issue payments, claim payments, checks, MICR checks, reconciliation, payee, claim settlements, claims processing improvement, increase customer satisfaction in insurance indust, lower cost of processing claims, reduce cost of processing claims, PayPilot, electronic payment, insureds, fees, check fraud, fraud, virtual credit card payments, virtual credit and debit card payments, virtual card payments, how do virtual card payments work, in-n-out single use card, single use cards, single use card number, accept virtual credit card payments, virtual card payment implementation, virtual card payment, single use card numbers, credit card single use number, single use card, virtual card payment program, virtual card payment solutions, virtual card payments healthcare providers, receiving virtual card payments, virtual card for provider payments, multi-party ACH payment, eChecks, electronic checks, MasterCard Send, direct-to-debit payment, WEX, Deluxe

Tags: issue payments electronically, remittance data, Outbound Payment Processing, disbursements, make the process better, flexibility, cost of issuing a paper check, single payment, reduce risk, SUA, card payments, control, issuing outbound payments, reduce the costs of issuing payments, speed of the transaction, disbursement processes, issue payments, claim payments, checks, MICR checks, reconciliation, payee, claim settlements, claims processing improvement, increase customer satisfaction in insurance indust, lower cost of processing claims, reduce cost of processing claims, PayPilot, electronic payment, insureds, fees, check fraud, fraud, virtual credit card payments, virtual credit and debit card payments, virtual card payments, how do virtual card payments work, in-n-out single use card, single use cards, single use card number, accept virtual credit card payments, virtual card payment implementation, virtual card payment, single use card numbers, credit card single use number, single use card, virtual card payment program, virtual card payment solutions, virtual card payments healthcare providers, receiving virtual card payments, virtual card for provider payments, multi-party ACH payment, eChecks, electronic checks, MasterCard Send, direct-to-debit payment, WEX, Deluxe

Profitability in healthcare has its financial challenges. Learn how to create a new revenue stream while improving efficiencies, cutting costs and improving reconciliation and remittance – PayPilot® with WEXHealth is the simple solution you are looking for.

Tags: issue payments electronically, remittance data, Outbound Payment Processing, disbursements, make the process better, flexibility, cost of issuing a paper check, single payment, reduce risk, SUA, card payments, control, issuing outbound payments, reduce the costs of issuing payments, speed of the transaction, disbursement processes, issue payments, claim payments, checks, MICR checks, reconciliation, payee, claim settlements, claims processing improvement, increase customer satisfaction in insurance indust, lower cost of processing claims, reduce cost of processing claims, PayPilot, electronic payment, insureds, fees, check fraud, fraud, virtual credit card payments, virtual credit and debit card payments, virtual card payments, how do virtual card payments work, in-n-out single use card, single use cards, single use card number, accept virtual credit card payments, virtual card payment implementation, virtual card payment, single use card numbers, credit card single use number, single use card, virtual card payment program, virtual card payment solutions, virtual card payments healthcare providers, receiving virtual card payments, virtual card for provider payments

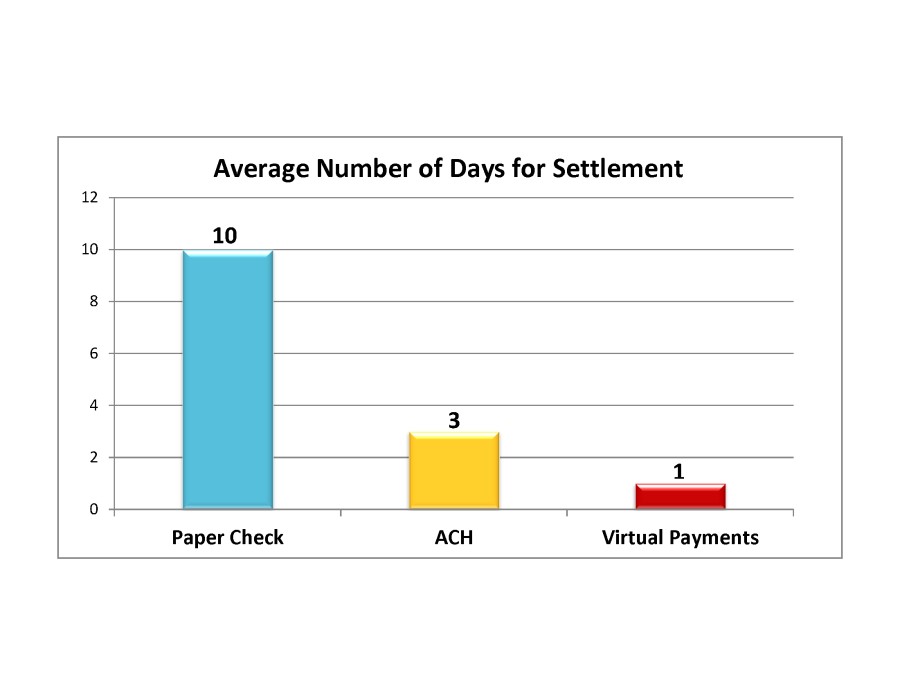

Tags: payment processing, ACH, issue payments electronically, remittance data, self-service capabilities, bank agnostic, disbursement workflow, nimbleness straight through processing, cost savings, lifecycle of existing systems, disbursement hub, Outbound Payment Processing, disbursements, make the process better, changes to process, competitive threat, flexibility, cost of issuing a paper check, improve process, approvals, bulking, remittance.electronic payments, issuing payments, electronic remittance, Positive Pay, Payee Positive Pay, card payments, bank account information, bank account info, originating systems, methods of payment, ancillary processing, issuing outbound payments, reduce the costs of issuing payments, new payment methods, payments by cards, payments on location, disbursement processes, issue claim payments, issue payments, claim payments, checks, MICR checks, reconciliation, transaction, claim settlements, enterprise-wide middleware, payment disbursement hub, insurance claims processing, claims processing improvement, lower cost of processing claims, reduce cost of processing claims, insurance industry trends, PayPilot, electronic payment, insureds, Catastrophic Events, CATs

If You Are Not Embracing Mobile In To Your Disbursement Strategy,

You May As Well Be Doing This!

Tags: payment processing, ACH, issue payments electronically, disbursement workflow, nimbleness straight through processing, disbursement hub, disbursements, security, single payment, issuing payments, Single Use Accounts, SUA, bank account information, issue payments to the one-off payees, originating systems, methods of payment, ancillary processing, issuing outbound payments, speed of the transaction, new payment methods, payments by cards, payments on location, disbursement processes, issue claim payments, issue payments, claim payments, claim settlements, payment disbursement hub, insurance claims processing, claims processing improvement, reduce cost of processing claims, insurance industry trends, mobile insurance solutions, insureds, Catastrophic Events, CATs, same-day cash

Tags: issue payments electronically, nimbleness straight through processing, disbursement hub, issue claim payments, issue payments, claim payments, claim settlements, enterprise-wide middleware, insureds, Catastrophic Events, CATs

Let Your Checks Bounce?

Guest Blogger forPrelude Software:

Larry J. Kane

iCareCard

So, you make a lot of payments every month, right? And, if you are like most companies, a good majority of those outbound payments are in the form of a check or an ACH transaction. You spend a lot of money and effort to issue those outbound payments, and you don’t get any “bounce” from your efforts. In fact, what you do get is the expense of cutting the check, which some statistics claim can be as high as $20.00 each, or creating the ACH file, etc. And to reward you even more for your efforts, you get the task of trying to obtain a Routing Number and Account Number from your payee if you want to pay by ACH, or the cost of tracking lost checks, re-issuance, reconciliation, etc, etc. So where is the bounce for you and for your payee? When you pay by check or ACH the payment is made; the money gets spent and the transaction has no more life, and no reward for either you or your payee.

Tags: ACH, disbursement workflow, cost savings, payments by cards, disbursement processes, issue claim payments, issue payments, checks, MICR checks, reconciliation, payee, transaction, claim settlements, insureds, same-day cash, iCareCard, re-issuance, reward, loaded, reloaded, Visa, discounts, payroll, commissions, dividends, refunds, interchange, fees, funds